Projects

Health Policy Analysis for Health Taxes

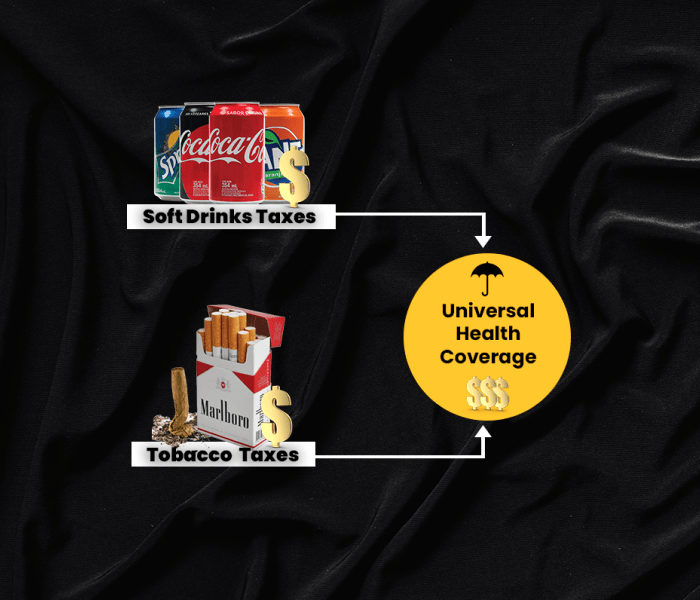

Pakistan is a country with high rates of tobacco and sugar consumption, posing significant public health challenges. According to the World Health Organization (WHO), tobacco use is a leading cause of preventable death worldwide, and it is estimated that smoking-related illnesses claim over 160,000 lives in Pakistan each year. Similarly, the consumption of excessive sugar is linked to various health issues such as obesity, diabetes, and heart disease.Onto Global, a team of experts, is currently examining the political-economy challenges impeding the adoption and adaptation of effective health taxes in Pakistan. Health taxes are one way to reduce tobacco and sugar consumption by increasing their prices and making them less affordable. The team of experts is examining the political and economic factors that influence tax policy in Pakistan, such as the role of industry lobbying, the impact on employment, and the perceived regressive nature of taxes.

The adoption and adaptation of effective health taxes in Pakistan can lead to significant public health benefits by reducing the prevalence of tobacco and sugar consumption. This would result in lower rates of smoking-related illnesses, obesity, diabetes, and heart disease, improving the overall health outcomes of the population. However, implementing health taxes requires navigating complex political and economic factors. The expertise of Onto Global can help to identify these challenges and propose solutions that can lead to effective tax policy in Pakistan.

Contact Us

- Private Limited Registered in Canada